Market Information > 한국농식품시장 개요

한국농식품시장 개요

Executive Summary

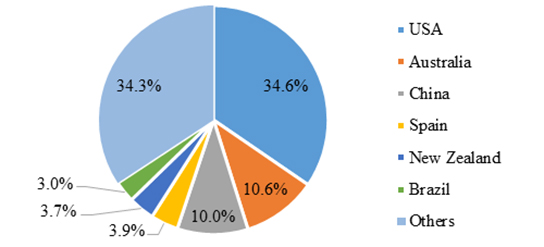

South Korea has the 10th largest economy in the world with a GDP of $1.8 trillion and a per capita GNI of $35,090 in 2022. It is about the size of Indiana and has a population of 51.6 million. Over 80 percent of Koreans live in urban areas. Domestic production meets only 46 percent of food demand. The United States exported $10.1 billion in agricultural and related products to Korea in 2022, making it our fifth largest country export market. The U.S. supplies a quarter of Korea's agricultural imports

Imports of Consumer-Oriented Products

Korea imported $19.3 billion in consumer-oriented products in 2022, accounting for 38.4 percent of agricultural imports. There are still many opportunities for U.S. export growth in this segment, including for beef, pork, fruits, tree nuts, dairy products, confectioneries, beverages, and further prepared foods.

Food Processing Industry

Korea had over 31,300 food processing companies as of 2021, generating $63.3 billion in sales. Korean food processing companies rely heavily on imported commodities and ingredients. Imports of basic and intermediate agricultural products totaled $20.9 billion in 2022. Seventeen percent ($3.6 billion) of these imports came from the United States.

Food Retail Industry

Korean retail food sales totaled $131 billion in 2022, accounting for 27 percent of total retail sales. Grocery supermarkets are the leading food retail channel, followed by on-line retailers, hypermarket discount stores, convenience stores, and department stores. On-line retailers and convenience store food sales are expected to grow faster than other channels over the next 5-10 years. The fast expansion of on-line retailers is forcing conventional retail channels to restructure space anddevi se new strategies to attract consumer traffic.

Quick Facts CY 2022

Imports of Ag. Products from the World

Top 10 Consumer-Oriented Ag. Imports from the World

Beef ($4.2B), Food Preparations ($2.3B), Pork ($2.0B), Alcoholic Bev $935M), Cheese and Curd ($800M), Preserved Fruits/Nuts ($453M), Poultry Meat ($452M), Bakeries ($419M), Preserved Vegetables ($389M), Chocolates ($363M),

Top 10 Growth Consumer-Oriented Ag. Imports

Vegetables under HS0703, Alcoholic Bev., lamb, butter, mineral waters, beef, processed fruits & nuts, coffee

Food Industry by Channels

Top Korean Retailers

EMART, LOTTE Mart, HOME PLUS, COSTCO, GS Retail (GS Super, GS25), BGF Retail (CU), Korea Seven, E Land Retail, Lotte Department Store, Shinsegae Department Store, Hyundai Department Store, Hanwha Galleria, CJ O Shopping, GS Home Shopping, SK Planet, Ebay Korea, Coupang

GDP/Population

Population: 51.8 million

GDP: US $1.6 trillion

GDP per capita: US $31,631

Strengths/Weaknesses/Opportunities/ Challenges

| Strengths | Weaknesses |

|---|---|

| Well established market with modern distribution channels | High logistics costs to ship American products |

| Consumer income level continues to increase | Consumers have limited understanding of American products |

| Opportunities | Challenges |

|---|---|

| Strong consumer demand for value, quality, and diversity | Elevated competition from export-oriented competitors |

| KORUS FTA reduces tariff barriers for American products. | Discrepancies in food safety and labeling regulations |

Data and Information Sources:

Korea Ministry of Food & Drug Safety, Korea National Statistics Office, Korea Int'l Trade Association, Global Trade Atlas, CIA Factbook. To the greatest extent possible, the latest available statistics are used in this publication.

Contact: U.S. Agricultural Trade Office(ATO) Seoul

E-mail: atoseoul@fas.usda.gov

For more detailed information about the Korean market see the Exporter Guide 2023.

Agricultural Trade Office, U.S. Embassy - Seoul

Tel: 82-2-6951-6848 Fax: 82-2-720-7921

Email: atoseoul@state.gov